Changes to preservation age

Since 1 July 2024, the age at which individuals can access their superannuation increased to age 60. So what does this mean for those planning on accessing their superannuation upon reaching this age?

What is preservation age?

Access to superannuation benefits is generally restricted to members who have reached ‘preservation age’ which is the minimum age at which you can access your superannuation benefits.

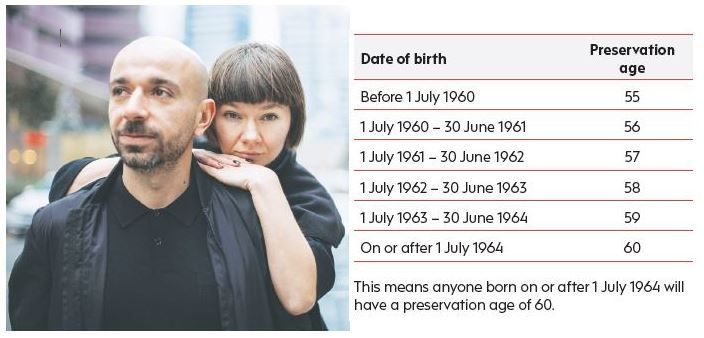

Prior to 1 July 2024, a person's preservation age could range from 55 to 60 as it depends on their date of birth. Preservation age has been slowly increasing over the years and has finally reached its legislated maximum age limit of age 60, as shown in the table above.

This means anyone born on or after 1 July 1964 will have a preservation age of 60.

Tip – it’s important to note that preservation age is not the same as your Age Pension age. To get the Age Pension, you must be age 67 or over, depending on when you were born (and other rules you need to meet). So even if you reach preservation age, it could be some time before you are eligible to receive the Age Pension from Services Australia (ie, Centrelink).

What does this change mean for me?

Once you have reached preservation age, you may receive your superannuation benefits as:

- A lump sum or as an income stream once you have retired (or a combination of both), or

- A transition to retirement income stream while you continue to work.

Furthermore, once you turn age 60 your superannuation benefits (ie, any lump sum withdrawals and/or pension payments) will generally be tax-free.

This change simplifies the tax rules as previously those between preservation age and age 60 were subject to tax on lump sum withdrawals and pension payments. Now, the tax treatment of superannuation benefits depends on whether you are above or below age 60 – there is no need to consider preservation age which is based on a person’s date of birth.

Need more information?

If you’re wondering what your superannuation withdrawal options are or how tax may apply to your superannuation benefits, transition to retirement or superannuation income streams, contact us today for a chat.

Previous Blog Posts: