Employees vs. Contractors: What Sets Them Apart

The Australian Taxation Office (ATO) has recently revised its guidance on differentiating between employees and independent contractors. This change follows several court rulings that clarified the criteria for determining whether a worker is genuinely an employee or an independent contractor.

Whether you’re a worker or a business owner, understanding these differences is crucial, as they have an impact on tax, superannuation, and workplace entitlements.

Why does the difference matter?

How a worker is classified – either as an employee or a contractor – impacts who is responsible for paying taxes, providing benefits like superannuation and leave, and who carries legal responsibilities. Misclassifying a worker can lead to serious financial consequences, including unpaid entitlements and penalties from the ATO.

Key differences between employees and contractors

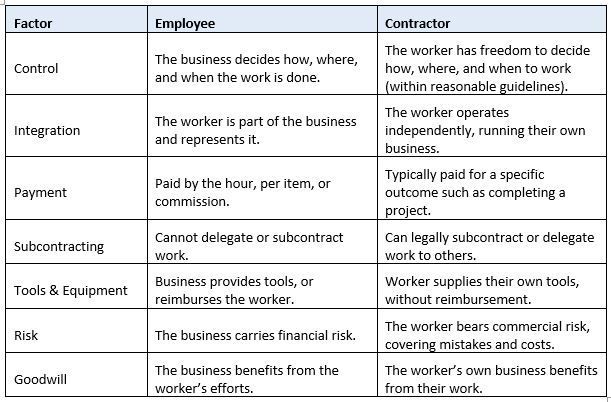

The primary difference lies in how the worker interacts with the business:

· Employees work in the business and are part of its operations.

· Contractors work for the business but maintain their own separate operation.

The contract between the business and the worker is crucial in determining a worker's classification. While day-to-day work practices play a role, the legal rights and responsibilities outlined in the contract hold the greatest significance.

See the table above for the ATO’s most important considerations.

Superannuation and contractors

Even if someone is considered a contractor, they might still be entitled to superannuation if:

· They’re paid mainly for their labour.

· They work as a sportsperson, artist, entertainer, or in a similar field.

· They provide services for performances or media production.

· They do domestic work for over 30 hours per week.

Workers who are always employees

Some workers are always considered employees, no matter what. This includes apprentices, trainees, labourers, and trades assistants.

Apprentices and trainees work while completing recognised training to earn a qualification, certificate, or diploma. They might be full-time, part-time, or even school-based and usually have a formal training agreement.

Most of these workers are paid under an award, meaning they have set pay rates and conditions. Businesses hiring them must follow the same tax and superannuation rules as they do for other employees.

Companies, trusts, and partnerships are always contractors

If a business hires a company, trust, or partnership (rather than a person) it’s always considered a contracting arrangement. However, people working for that entity could still be employees of that entity, rather than the business hiring the services.

Why this matters to you?

For workers, knowing your status helps ensure you receive the correct pay and benefits. For businesses, classifying workers correctly helps avoid fines and ensures compliance with tax and employment laws.

If you need more details or want to check your situation, reach out to us for more information. Proper classification today can prevent costly mistakes in the future.

Previous Blog Posts: