SMSFs Borrowing to Invest

SMSFs Borrowing to Invest

Thinking about using your SMSF to borrow to invest? SMSF borrowing has become a popular way of maximising retirement savings because it allows you to increase the amount available to invest within your SMSF.

SMSFs are generally not allowed to borrow money. However there are some limited exceptions including borrowing to invest under a specific type of borrowing arrangement called a ‘limited recourse borrowing arrangement’ (LRBA).

What is an LRBA?

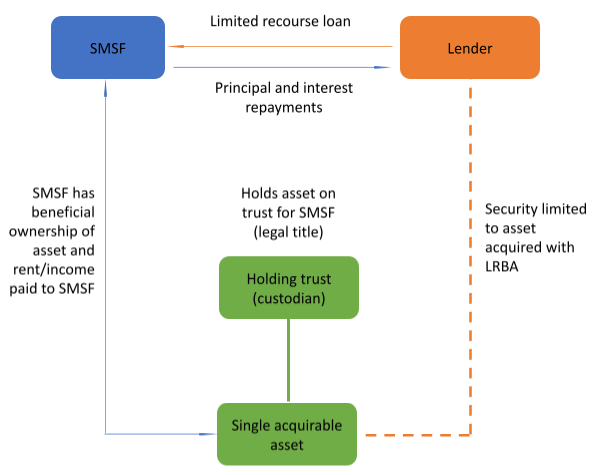

An LRBA is a type of loan structure designed for SMSFs that involves establishing a ‘holding trust’ (also called a ‘bare trust’) where the trustee of this trust (also known as the custodian) legally holds the asset on behalf of the SMSF trustee/director.

The borrowing must be on a ‘limited recourse’ basis for the purpose of acquiring an asset that is held on trust until the borrowing has been repaid. This means the lender’s recourse is limited to the asset being bought under the arrangement. For example, if your SMSF is unable to meet its loan obligations, the bank can only access the asset that was purchased using the loan (ie, the bank cannot take other assets of the fund).

However, to protect themselves from this happening, most banks require you to provide a personal guarantee for the loan so that in the event of a default, the bank would seize your personal assets given that they can’t access your SMSF assets. This potential personal exposure should be factored in when contemplating entering into an LRBA.

The Holding Trust

As mentioned above, a LRBA involves establishing a ‘holding trust’ for the sole purpose of legally holding the asset on behalf of the SMSF for the duration of the loan. This holding trust arrangement recognises that the asset is to be held by the trust until the debt is repaid, at which point legal ownership can pass to the SMSF.

The asset that is held on trust for the SMSF must be an asset that the SMSF would be permitted to invest in directly. In most cases, an LRBA is used to purchase real property. However, it may also be possible to purchase a parcel of shares in the same company or units in a managed fund using an LRBA, subject to certain conditions being met.

The diagram below illustrates the structure of a typical LRBA.

Once the loan has been repaid, the arrangement can then be unwound and legal title to the asset transferred to the SMSF or the holding trust can continue to hold the asset.

The Pros

- Using a LRBA can allow your SMSF to purchase an asset (ie, property) which may otherwise be out of reach were the SMSF not to borrow.

- Your SMSF will receive all of the income and deductions, without having to fund the entire purchase price upfront.

- Growth of the asset occurs in the concessionally taxed superannuation environment. That is, superannuation funds pay tax at a maximum rate of 15% and the rate of tax on capital gains where an asset is held for more than 12 months effectively reduces to 10% on the ultimate disposal of the asset. Further, if the asset is a segregated pension asset and fully supports a retirement phase pension interest at the time of disposal, capital gains tax may not be payable at all.

- SMSF members can make contributions to superannuation, including tax deductible contributions, in order to pay down the LRBA.

The Cons

- Potential personal exposure in the event of a loan default by the SMSF (see earlier).

- LRBAs are complex as certain conditions must be met in order for the LRBA to comply with superannuation law. This means advice from qualified professionals is needed to set them up which can increase the set up costs when compared to borrowing outside of the superannuation environment.

- Potential stamp duty costs and implications can arise from setting up the LRBA structure.

- If the strict requirements of the LRBA rules are not met, the fund will be in breach of the superannuation law which could result in severe penalties for your SMSF.

- An LRBA can only be used to purchase a ‘single acquirable asset’, which can be quite restrictive.

- Although gearing can deliver benefits when the capital value of the investment increases, gearing can also magnify losses if the capital value of the investment falls. Thus, the profitability of a gearing strategy depends on the income and capital growth of the proposed investment being greater than the borrowing and ongoing costs.

- Potential illiquidity risk – if the asset acquired represents a large portion of the SMSF's total assets and the asset cannot be sold quickly in order for the SMSF to meet its obligations, the SMSF may need to sell the asset at an inappropriate time, such as when it is valued at less than the amount outstanding on the loan.

- If the asset is property:

- There is a potential risk that tenants are unable to pay rent, or the property is not rented.

- There are restrictions on the type of work that can be carried out on a property while the LRBA is still in place. This is because SMSFs cannot significantly change the character of the property while it is subject to borrowing. For example, a vacant block of land could not be built on, nor subdivided, while the loan is still in place.

- The outstanding balance of the LRBA entered into from 1 July 2018 is included in your total superannuation balance if:

- You satisfy a condition of release that allows you full access to your superannuation (ie, such as retirement, terminal illness, permanent incapacity and reaching age 65), or

- The loan is provided by an associate, which includes members of the SMSF, relatives and related entities (such as companies and trusts).

As can be seen, there are a number of rules to follow so it is crucial you seek specialist advice to determine whether LRBAs are right for your SMSF.

This information is general in nature. It has been prepared without taking into account your objectives, personal or business circumstances, financial situation or needs. Because of this, you should, before acting on this information, consider in consultation with your adviser, its appropriateness, having regard to your objectives, personal or business circumstances, financial situation and needs.

Previous Blog Posts: