Super contribution caps to increase on 1 July

For the first time in three years, the superannuation contributions are set to increase from 1 July 2024.

Contribution caps to increase

Due to indexation, the contribution caps will increase on 1 July 2024 as follows:

- Concessional contributions cap – from $27,000 to $30,000

- Non-concessional contributions cap – from $110,000 to $120,000

- The maximum non-concessional contributions cap under the bring forward rules – from $330,000 to $360,000

What are concessional contributions?

Concessional contributions (CC) are before-tax contributions and are generally taxed at 15%. This is the most common type of contribution individuals receive as it includes superannuation guarantee (SG) payments your employer makes into your fund on your behalf. Other types of CCs include salary sacrifice contributions and tax-deductible personal contributions.

The government sets limits on how much money you can add to your superannuation each year. Currently, the annual CC cap is $27,500 in 2023/24.

What are non-concessional contributions?

Non-concessional contributions (NCC) are voluntary contributions you can make from your after-tax dollars. For example, you may wish to make extra contributions using funds from your bank account or other savings.

As such, NCCs are an after-tax contribution because your employer has already taken out the tax you need to pay on your income. Currently, the annual NCC cap is $110,000 in 2023/24.

What are the bring forward rules?

The bring forward rules apply to NCCs and allow you to make up to three years of NCCs in a single financial year, if you’re eligible. This means you can put in up to three times the annual cap of $110,000, which means you may be able to top up your superannuation by $330,000 within the same financial year.

Using the bring forward rules can be beneficial for individuals who have a large amount of cash to invest which may have come from an inheritance or from the sale of an asset/property.

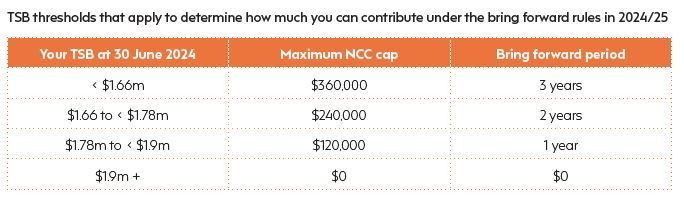

However, how much you can make as a NCC will depend on your total superannuation balance (TSB) as at 30 June of the previous financial year (see table above).

Bring forward NCC amounts will also increase

In addition to the contribution caps increasing, the maximum NCC cap under the bring forward rules will also increase on 1 July 2024.

The table above shows the TSB thresholds that apply to determine how much you can contribute under the bring forward rules.

Take care before you contribute

The increase to the NCC cap under the bring forward rules will not apply to individuals who have already triggered the bring forward rule in either this year (2023/24) or last year (2022/23) and are still in their bring forward period. This is because the NCC cap that applies to an individual is calculated with reference to the standard NCC cap when they triggered the bring forward rule in their first year.

For example, if the NCC cap in the second and third year of a bring forward period changed to $120,000 due to indexation, your NCC cap will still be $330,000 ($110,000 x 3 years) and not $350,000 ($110,000 + $120,000 + $120,000).

For this reason, if you want to maximise your NCCs using the bring forward rule, you may wish to consider restricting your NCCs this year to $110,000 or less so you do not trigger the bring forward rule this year.

However, how much you can contribute and whether your fund is allowed to accept your contribution can depend on your age, your TSB and other eligibility criteria. The rules are complex and making contributions to superannuation that exceed the contribution caps can result in excess tax.

Give us a call if you need any further information or would like to chat about your options.

Previous Blog Posts: