Take care with contribution timing this financial year

Are you are planning to maximise your superannuation contribution caps this financial year? If so, it’s crucial to get the timing right so your contribution is received by your superannuation fund in the current financial year.

Lessons from a recent court case

A recent court case[1] has confirmed that contributions are made on the date they are received by a member’s superannuation fund, not when they are made. The member in this case had intended that his contributions be attributed in the year the payments were made (ie, in late June) rather than on the dates they were received (ie, in early July).

However the ATO and the Administrative Appeals Tribunal ruled that the contributions were made on the dates the funds were received by his superannuation fund, rather than the date of payment initiation. This meant that the member’s contributions were deemed to be made in the next financial year which placed the transactions into the next financial year with other contributions the member made that year, causing the member to exceed his contribution caps.

The ATO view on when a contribution is made

The timing of when a contribution is made is important for a number of reasons, particularly when this occurs close to 30 June. For example, the timing can impact when the contribution will count towards your contribution caps, whether your fund is able to accept your contribution(s) or whether a tax deduction may be claimed for your contribution(s).

The ATO’s Taxation Ruling[2] on superannuation contributions confirms that a contribution is made when the capital of the fund is increased. This occurs when an amount is received, or ownership of an asset is obtained, or a fund otherwise obtains the benefit of an amount.

For example, a contribution of money via an electronic transfer is made when the amount is credited to your superannuation fund’s bank account, not when you press the button to effect the payment.

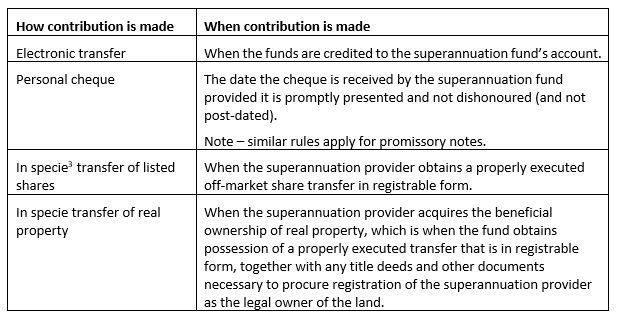

The above table summarises some of the common ways in which funds are transferred and when the contribution is deemed to be made. Please note this list is not exhaustive.

Timing is key

This year 30 June falls on a Sunday (a non-business day), so leaving it to the last minute and making a contribution over the weekend may not provide enough time for your contribution to reach your superannuation fund as transfers typically happen on business days.

If you are a member of a large APRA-regulated superannuation fund, make sure you know when the cut-off day is as this is the date your fund will accept contributions so that they will be allocated in that same financial year. Otherwise, there is no guarantee that contributions received after this date will be allocated before the end of the financial year. In the end, a contribution received by your fund on 1 July 2024 is a contribution that will be treated as belonging to the 2024-25 financial year.

On the other hand, if you have an SMSF, electronic transfers between accounts with the same bank generally happen immediately which means contributions will be made instantaneously and therefore count towards your contribution caps this financial year. This can be helpful if you end up making contributions last minute. However, a transfer between different banks is likely to take longer to clear which could see your SMSF receiving the transfer of funds after it was initiated by you as the contributor.

Superannuation clearing house delays

You should also take extra care if your employer makes contributions to your fund by using a superannuation clearing house as there can be a time delay from when your employer’s payment is made to the clearing house and when your superannuation fund receives the contribution. This is because contributions made by employers to a clearing house generally do not constitute the receipt of a contribution by a superannuation fund as a contribution cannot be recorded by the superannuation fund until it is received. This could see last minute 2023-24 superannuation contributions by employers not reach their employee’s fund in time to be recorded as a contribution in 2023-24 and may end up being recorded in the 2024-25 financial year. This could cause you to exceed your concessional contribution cap if you are also planning on making a personal superannuation contribution and claiming the amount as a tax deduction.

Key takeaway

The bottom line is to allow plenty of time to make your superannuation contributions well before 30 June in order for your contribution to be received by your superannuation fund this financial year because in the end, a contribution is deemed to be made at the time it is received by your superannuation fund, not when you process the transaction.

[1] Mackie v Commissioner of Taxation [2024] AATA 619, 3 April 2024.

[2] Taxation Ruling TR 2010/1.

Previous Blog Posts: